Jianing Zhang

-

Position:Coordinator of Finance

-

Office:CBPM B311

-

Email:

Education

Ph.D. in Finance, Pennsylvania State University, University Park, USA, 2008 – 2013

Ph.D. in Polymer Science, University of Massachusetts, Amherst, USA, 2002 – 2008

M.S. in Macromolecular Science, Fudan University, China, 1999 – 2002

B.E. in Polymer Engineering, Tongji University, China, 1995 – 1999

Professional Experience

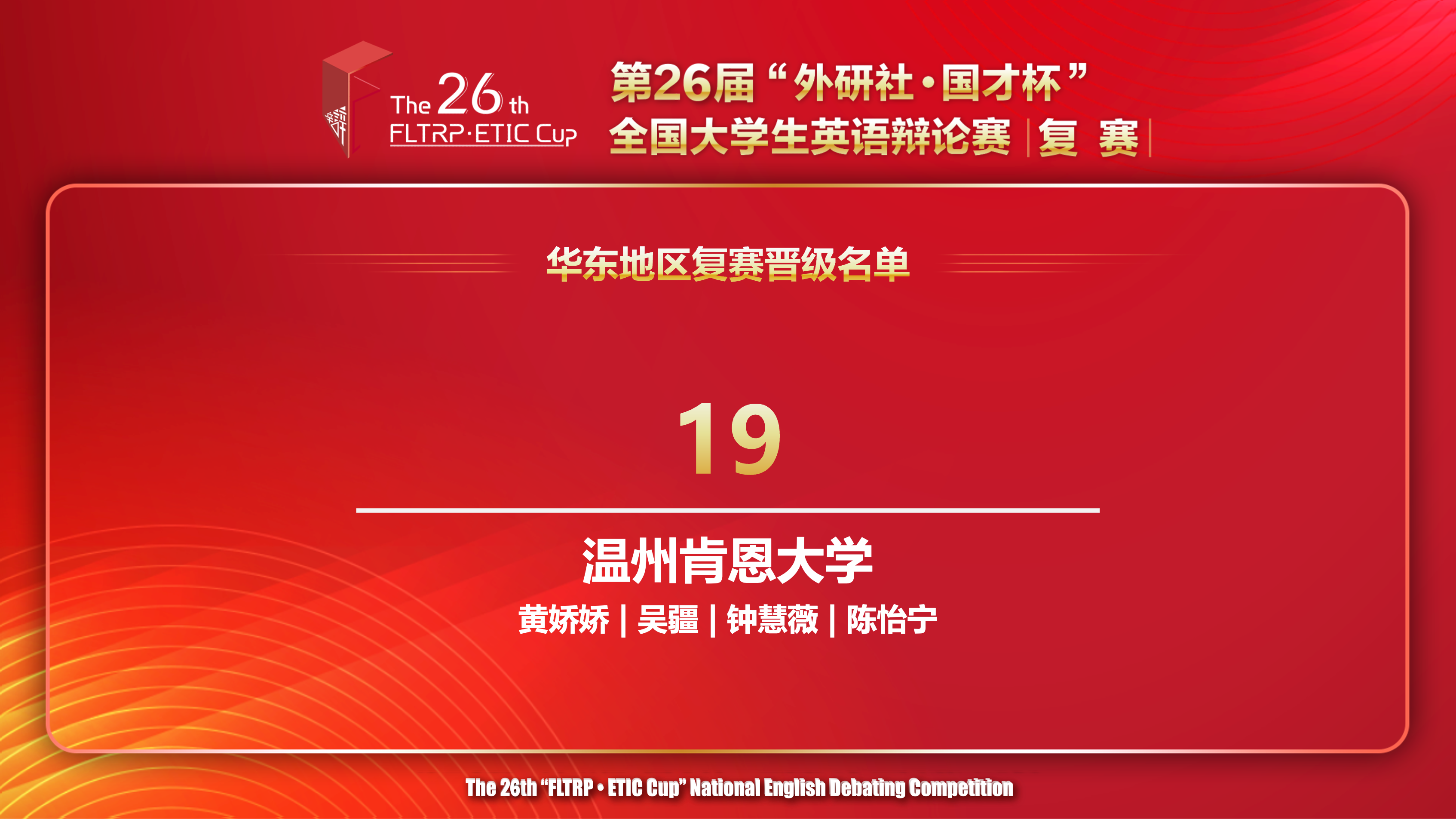

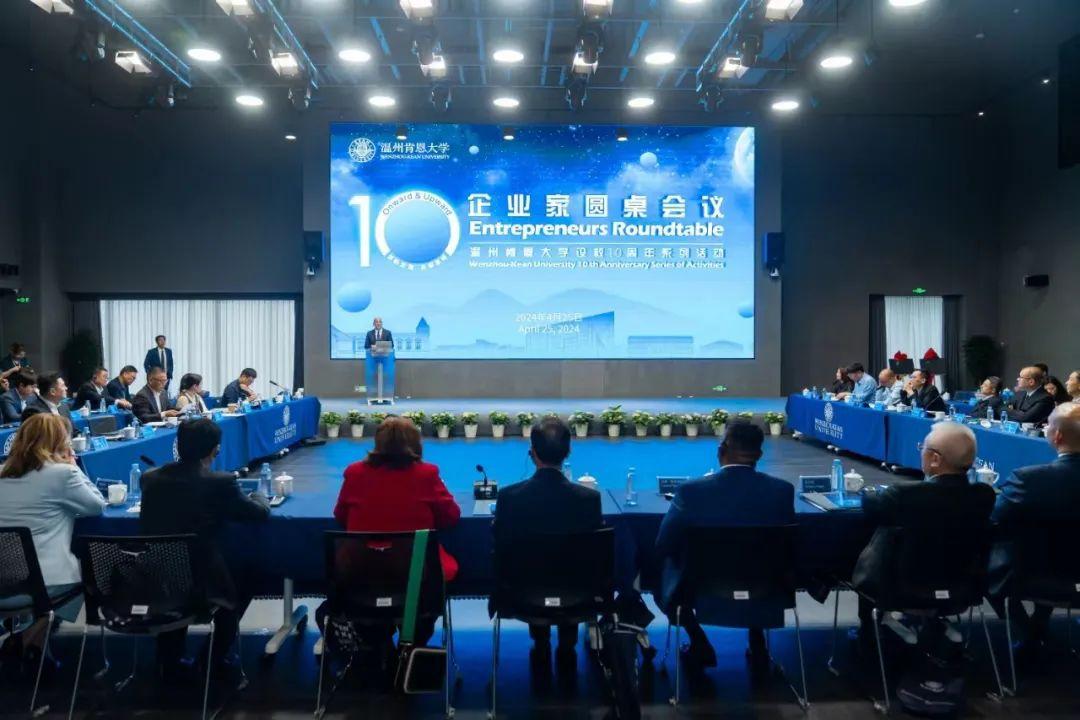

Assistant Professor of Finance, College of Business and Public Management, Wenzhou-Kean University, China, 2019 – Present

Associate Professor of Finance, School of Finance, Shanghai University of Finance and Economics, China, 2016 – 2019

Assistant Professor of Finance, School of Finance, Shanghai University of Finance and Economics, China, 2013 – 2016

Biography

Born in Henan province of China, Dr. Zhang is a U.S. citizen with Chinese permanent resident status. He holds a Ph.D. in Finance from the Pennsylvania State University and another Ph.D. in Polymer Science from the University of Massachusetts. Before joining WKU in 2019, he was an associate professor of finance in the School of Finance at the Shanghai University of Finance and Economics.

Dr. Zhang’s research interests focus on mutual funds, fixed income, credit derivatives, and corporate finance. He has published extensively in academic journals, including Journal of Banking & Finance, Finance Research Letters, Financial Review, International Review of Financial Analysis, International Review of Economics & Finance, International Journal of Finance & Economics, International Journal of Emerging Markets, Cogent Economics and Finance, Review of Pacific Basin Financial Markets and Policies, Asia-Pacific Financial Markets, and International Advances in Economic Research. Dr. Zhang's works are accessible on Google Scholar: https://scholar.google.com/citations?user=xruHffsAAAAJ

Dr. Zhang has received multiple awards and recognitions for his academic achievements. In 2014, he was enrolled in the Pujiang Talent Program of Shanghai, and in 2022, he was selected for the Ouyue Talent Program (Class D Talent) of Wenzhou. He won the WKU Award for Excellence in Research and Creativity in 2023. He is also an Honorable member of the European Institute for Research & Development and a member of the Zhejiang Society of Graduate Education (ZSGE) Expert Pool. Dr. Zhang is the first participant in two projects sponsored by the National Natural Science Foundation of China, and is a member of the Center for Big Data and Decision-Making Technologies as well as the Wenzhou Doctoral Innovation Station. He also heads the WKU Quantitative Finance Research Institute, the Department of Education of Zhejiang Province General Program, the Wenzhou Philosophy and Social Science Key Research Center Program, and the Wenzhou Association for Science and Technology—Service and Technology Innovation Program.

Dr. Zhang’s teaching excellence is also highly regarded. His course FIN 3380, “Introduction to Derivatives,” was rated as the First Rated Course in Zhejiang Province in 2021. He won the WKU Award for Excellence in Teaching in 2022. The student team mentored by Dr. Zhang won a Merit Award in the 2021 S&P Global Corporate Valuation Challenge, and won the second and third prizes in the 2021 DGM Corporate Valuation Challenge. The finance club he advised has won the WKU Four-star Student Club honor multiple times.

Research Interests

Dr. Zhang’s research interests include mutual funds, fixed income, credit derivatives, and corporate finance.

- Equity and bond mutual funds

- Exchange-traded funds

- Government and corporate bonds

- Credit default swaps

- Environmental, social, and governance

Teaching

- GMBA 5350: Multinational Financial Management

- FIN 4998: Senior Thesis

- FIN 3380: Introduction to Derivatives

- FIN 3320: Preparation and Analysis of Financial Statements

- FIN 3310: Management of Corporate Finance I

- Investments

- Asset Pricing: Theories and Applications

- Security Analysis and Portfolio Management

Publications

- Xu, Q., Xue, C., & Zhang, J. (2024). The impact of CEO’s age on corporate performance in the medical industry: Evidence from China. International Journal of Monetary Economics and Finance, forthcoming. (ABDC−C, Scopus−Q3, Scimago−Q4).

- Wen, R., Xue, C., & Zhang, J. (2024). The relationship between CEO characteristics and corporate social responsibility: Evidence from China. International Symposia in Economic Theory and Econometrics, forthcoming. (Scopus−Q3, Scimago−Q4).

- Yao, S., & Zhang, J. (2024). The informativeness of the top holdings of Chinese equity mutual funds. International Journal of Emerging Markets, published online. (CAS−IV, SSCI−Q2, ABS−1, ABDC−B, Scopus−Q1, Scimago−Q2). https://doi.org/10.1108/IJOEM-04-2022-0553

- Baklaci, H.F., Cheng, I.W., & Zhang, J. (2024). Performance attributes of environmental, social, and governance exchange-traded funds. Asia-Pacific Financial Markets, published online. (ESCI−Q3, ABS−2, ABDC−C, Scopus−Q2, Scimago−Q3). https://doi.org/10.1007/s10690-023-09416-9

- Xu, L., Xue, C., & Zhang, J. (2024). The impact of investor sentiment on stock liquidity of listed companies in China. Investment Management and Financial Innovations, 21(2), 1−14. (ABDC−B, Scopus−Q2, Scimago−Q4). https://doi.org/10.21511/imfi.21(2).2024.01

- Ma, J., Feng, J., Chen, J., & Zhang, J. (2024). Volatility spillover from carbon prices to stock prices: Evidence from Chinas carbon emission trading markets. Journal of Risk and Financial Management, 17(3), 123. (ESCI−Q2, ABDC−B, Scopus−Q2, Scimago−Q3). https://doi.org/10.3390/jrfm17030123

- Zhao, W., & Zhang, J. (2024). Investor attention and stock liquidity in Chinese market. International Advances in Economic Research,30(1), 65−82. (ESCI−Q3, ABS−1, ABDC−C, Scopus−Q2, Scimago−Q3). https://doi.org/10.1007/s11294-024-09885-2

- Wang, L., Weng, Z., Xue, C., & Zhang, J. (2024). ESG ratings and stock performance in the internet industry. Investment Management and Financial Innovations, 21(1), 38−50. (ABDC−B, Scopus−Q2, Scimago−Q4). https://doi.org/10.21511/imfi.21(1).2024.04

- Wang, K., Ma, J., Xue, C., & Zhang, J. (2024). Board gender diversity and firm performance: Recent evidence from Japan. Journal of Risk and Financial Management, 17(1), 20. (ESCI−Q2, ABDC−B, Scopus−Q2, Scimago−Q3). https://doi.org/10.3390/jrfm17010020

- Zhang, Q., & Zhang, J. (2023). Carbon pricing and stock performance: Evidence from China’s emissions trading scheme pilot regions. Review of Pacific Basin Financial Markets and Policies, 26(4), 2350024. (ESCI−Q4, ABDC−B, Scopus−Q3, Scimago−Q4). https://doi.org/10.1142/S0219091523500248

- Yang, X., Zhu, J., Xie, H., & Zhang, J. (2023). Liquidity spillover from carbon emission trading markets to stock markets in China. Investment Management and Financial Innovations, 20(4), 227−241. (ABDC−B, Scopus−Q2, Scimago−Q4). https://doi.org/10.21511/imfi.20(4).2023.19

- Hu, J., Li, K., Xia, Y., & Zhang, J. (2023). Gender diversity and financial flexibility: Evidence from China. International Review of Financial Analysis, 90, 102934. (CAS−I, SSCI−Q1, ABS−3, ABDC−A, Scopus−Q1, Scimago−Q1). https://doi.org/10.1016/j.irfa.2023.102934

- Li, K., Xia, Y., & Zhang, J. (2023). CEOs’ multicultural backgrounds and firm innovation: Evidence from China. Finance Research Letters, 57, 104255. (CAS−II, SSCI−Q1, ABS−2, ABDC−A, Scopus−Q1, Scimago−Q1). https://doi.org/10.1016/j.frl.2023.104255

- Liang, Y., Xue, C., & Zhang, J. (2023). The impact of ESG ratings on stock liquidity risk: Evidence from the Chinese market. Review of Integrative Business and Economics Research, 12(4), 1−16. (Scopus−Q3). https://doi.org/10.58745/riber_12-4_1-16

- Lai, S., Pu, X., Wang, Q., & Zhang, J. (2023). Reference prices and withdrawn acquisitions. International Journal of Finance & Economics, 28(4), 4365−4384. (CAS−III, SSCI−Q2, ABS−3, ABDC−B, Scopus−Q2, Scimago−Q2). https://doi.org/10.1002/ijfe.2655

- Wu, Y., & Zhang, J. (2023). How do inequality and George Floyd’s protests affect the vote shares of Trump? Eurasian Studies in Business and Economics, 26, 323−338. (Scopus−Q4, Scimago−Q4). https://doi.org/10.1007/978-3-031-30061-5_20

- Cai, X., & Zhang, J. (2023). The impact of COVID-19 on the liquidity of Chinese corporate bonds. Eurasian Studies in Business and Economics, 26, 285−300. (Scopus−Q4, Scimago−Q4). https://doi.org/10.1007/978-3-031-30061-5_18

- Yu, H., & Zhang, J. (2023). The impact of the COVID-19 pandemic on bitcoin prices. Eurasian Studies in Business and Economics, 26, 221−234. (Scopus−Q4, Scimago−Q4). https://doi.org/10.1007/978-3-031-30061-5_14

- Ding, Z., & Zhang, J. (2023). The impact of government subsidies on the innovation of new energy vehicle companies. International Journal of Monetary Economics and Finance, 16(3−4), 213−221. (ABDC−C, Scopus−Q3, Scimago−Q4). https://doi.org/10.1504/IJMEF.2023.131890

- Han, T., & Zhang, J. (2023). The impact of continuous tightening policies on China’s real estate industry. International Journal of Monetary Economics and Finance, 16(3−4), 188−196. (ABDC−C, Scopus−Q3, Scimago−Q4). https://doi.org/10.1504/IJMEF.2023.131891

- Fei, F., & Zhang, J. (2023). Chinese stock market volatility and herding behavior asymmetry during the COVID-19 pandemic. Cogent Economics & Finance, 11(1), 2203436. (ESCI−Q2, ABS−1, ABDC−B, Scopus−Q2, Scimago−Q3). https://doi.org/10.1080/23322039.2023.2203436

- Jiang, Y., & Zhang, J. (2023). The relationship between capital structure and performance of real estate companies in China. International Symposia in Economic Theory and Econometrics, 31, 217−233. (Scopus−Q3, Scimago−Q4). https://doi.org/10.1108/S1571-038620230000031028

- Hu, Z., & Zhang, J. (2023). Influence of bank loans on listed company performance: Evidence from China. International Symposia in Economic Theory and Econometrics, 31, 203−216. (Scopus−Q3, Scimago−Q4). https://doi.org/10.1108/S1571-038620230000031026

- Jin, J., & Zhang, J. (2023). The stock performance of green bonds issuers during COVID-19 pandemic: The case of China. Asia-Pacific Financial Markets, 30(1), 211−230. (ESCI−Q3, ABS−2, ABDC−C, Scopus−Q2, Scimago−Q3). https://doi.org/10.1007/s10690-022-09386-4

- Meles, A., Salerno, D., Sampagnaro, G., Verdoliva, V., & Zhang, J. (2023). The influence of green innovation on default risk: Evidence from Europe. International Review of Economics & Finance, 84, 692−710. (CAS−II, SSCI−Q1, ABS−2, ABDC−A, Scopus−Q1, Scimago−Q1). https://doi.org/10.1016/j.iref.2022.11.036

- Zhang, J., Xue, C., & Zhang, J. (2023). The impact of CEO educational background on corporate risk-taking in China. Journal of Risk and Financial Management, 16(1), 9. (ESCI−Q2, ABDC−B, Scopus−Q2, Scimago−Q3). https://doi.org/10.3390/jrfm16010009

- Yang, Y., & Zhang, J. (2022). The impact of COVID-19 on the performance of Chinese online educational industry. Review of Integrative Business and Economics Research, 11(4), 91−100. (Scopus−Q3). https://doi.org/10.58745/riber_11-4_91-100

- Lai, S., Liang, H., Liu, Z., Pu, X., & Zhang, J. (2022). Ownership concentration among entrepreneurial firms: The growth-control trade-off. International Review of Economics & Finance, 78, 122−140. (CAS−II, SSCI−Q1, ABS−2, ABDC−A, Scopus−Q1, Scimago−Q1). https://doi.org/10.1016/j.iref.2021.11.005

- Ji, W., & Zhang, J. (2022). The impact of COVID-19 on the E-commerce companies in China. Review of Integrative Business and Economics Research, 11(1), 155−165. (Scopus−Q3). https://doi.org/10.58745/riber_11-1_155-165

- Grishchenko, O., Vanden, J., & Zhang, J. (2016). The informational content of the embedded deflation option in TIPS. Journal of Banking & Finance, 65, 1−26. (CAS−II, SSCI−Q1, ABS−3, ABDC−A*, Scopus−Q1, Scimago−Q1). https://doi.org/10.1016/j.jbankfin.2015.12.004

- He, Z., Yang, J., & Zhang, J. (2014). Hedge Fund. In: Chen, X. and Liu, Y. (Eds.), Financial Institutions and Risk Management. Truth & Wisdom Press, pp. 143−166.

- Pu, X., & Zhang, J. (2012). Can dual-currency sovereign CDS predict exchange rate returns? Finance Research Letters, 9(3), 157−166. (CAS−II, SSCI−Q1, ABS−2, ABDC−A, Scopus−Q1, Scimago−Q1). https://doi.org/10.1016/j.frl.2012.01.001

- Pu, X., & Zhang, J. (2012). Sovereign CDS spreads, volatility, and liquidity: Evidence from 2010 German short sale ban. Financial Review, 47(1), 171−197. (ESCI−Q3, ABS−3, ABDC−A, Scopus−Q2, Scimago−Q1). https://doi.org/10.1111/j.1540-6288.2011.00325.x

- Zhang, J., & Murugappan M. (2009). Simulations of nucleation and elongation of amyloid fibrils. Journal of Chemical Physics, 130(3), 035102. (CAS−II, SCI−Q1, Scopus−Q1, Scimago−Q1). https://doi.org/10.1063/1.3050295

- Zhang, J., & Murugappan M. (2007). Monte Carlo simulations of single crystals from polymer solutions. Journal of Chemical Physics, 126(23), 234904. (CAS−II, SCI−Q1, Scopus−Q1, Scimago−Q1). https://doi.org/10.1063/1.2740256

- Zhang, J., Jiang, X., Zhang, H., & Yang, Y. (2002). Studies of viscoelastic effects on the phase separation dynamics of polymer mixtures. Journal of Fudan University (Chinese) , 41(3), 301−308. https://link.cnki.net/doi/10.15943/j.cnki.fdxb-jns.2002.03.013

- Zhang, J., Zhang, Z., Zhang, H., & Yang Y. (2001). Kinetics and morphologies of viscoelastic phase separation, Physical Review E, 64(5), 051510. (CAS−III, SCI−Q1, Scopus−Q1, Scimago−Q1). https://doi.org/10.1103/PhysRevE.64.051510

- Zhong, S., Zhang, J., & Li, P. (2001). Present situation and future of plastic materials database. China Plastics (Chinese), 15(8), 15−20. https://doi.org/10.19491/j.issn.1001-9278.2001.08.004